IARN — Front month corn futures broke the four-dollar barrier Friday, after the U.S. Department of Agriculture (USDA) released its October World Agricultural Supply and Demand Estimates (WASDE) report.

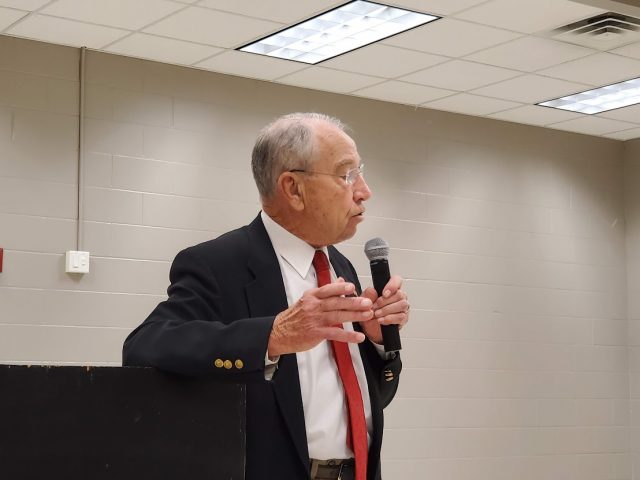

Greg McBride, commodities broker with Allendale, Inc., says, “We knew this report was going to be friendly, and it was.”

“(It was) much better than expected on the bean side with a new ending stock number of 290 million bushels. That was down from 460 million bushels, and more of a drop than expected,” McBride said. “What that implies, with 290 million bushels, is about 11-dollar beans. That doesn’t even take into account the possible issues with dryness in South America.”

Agency officials also made sizable adjustments to soybean exports and harvested acres. One area left untouched, however, was soybean yield, adds Jim McCormick, branch manager of Ag Market.

“The wildcard now is they left the bean yield unchanged, which keeps things interesting as we go through the latter part of harvest,” McCormick says. “As these yields start to slip back and you lose another half a bushel, you’re tightening the ending stock up to a bullish number. It looks like we have more debate and excitement as we go through harvest.”

McBride and McCormick both encourage producers to “pay attention to what the markets are doing,” especially when it comes to soybeans.

“You’ve seen the carry in the market, from November to July, has gone inverse, which is showing very strong demand. What you’re seeing here, after today’s report, is that starting to flip back. We may start building a carry in, which could signal an end of a rally here,” McBride says.

Story courtesy of the Iowa Agribusiness Radio Network.

Image source: United States Department of Agriculture.