Des Moines, Iowa — A State Senate Subcommittee has approved a bill, SSB1126, that would gradually eliminate the state income tax if state tax revenues continue to grow.

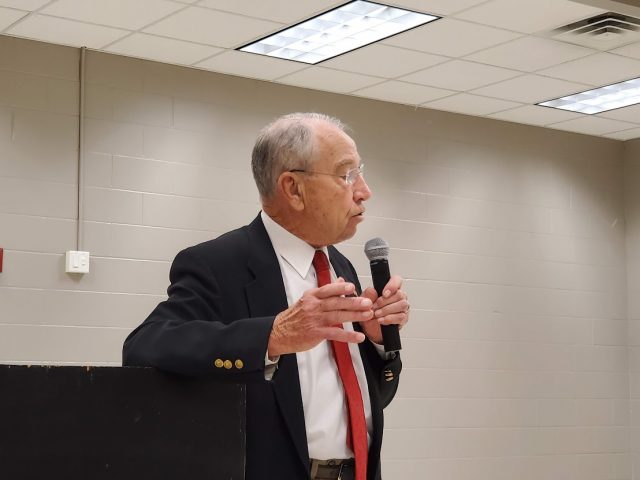

Senator Dan Dawson, a Republican from Council Bluffs, is chairman of the Senate Ways and Means Committee.

Governor Reynolds signed a bill into law last year that will gradually reduce the state income tax to 3.9 percent. This new bill would cut the rate to 2 ½ percent by 2028, and it would reduce Iowa’s corporate income tax from 5 ½ percent to 4.9 percent.

The five Democrats on the committee voted against the move. Senator Herman Quirmbach of Ames says getting rid of the state income tax will lead to cuts in state services.

Quirmbach says 56 percent of the state budget is spent on education and getting rid of half of state tax revenue would mean the state universities would dramatically raise tuition and class sizes would double in K-through-12 schools.

Dawson says cuts won’t be necessary if the state budget and tax cuts are managed appropriately. He says under the bill, state income taxes are only reduced if there’s money in the Taxpayer Relief Fund. State tax revenue that’s above expectations or left unspent at the end of a budgeting year is deposited in that fund.

SSB1126 has now been placed on the Ways and Means Committee calendar as SF552.

Republican lawmakers are also developing a plan to reduce property taxes. Governor Reynolds says she’s left drafting of property tax cuts up to lawmakers because her priority this year was state-funded education savings accounts for private school expenses.